Table Of Contents

Risk assessment just got a major upgrade. After four months of intensive development and testing, PRISM 2.0 is here. It's not just an update—it's a complete reimagining of how we measure portfolio risk.

Let's dive into what makes this upgrade significant for advisors and their clients.

What's New in PRISM 2.0?

PRISM 2.0 introduces fundamental improvements across three dimensions:

|

Dimension |

What Changed |

Why It Matters |

|---|---|---|

|

Accuracy |

Added holdings-level analysis and Value at Risk (VaR) metrics |

Catches hidden risks that surface-level analysis misses |

|

Speed |

Moved to serverless architecture |

Processes 1000+ position portfolios in under 10 seconds |

|

Sophistication |

Enhanced security classification system |

Properly handles leveraged ETFs, inverse funds, and buffer products |

The Four Game-Changing Enhancements

1. Smarter Volatility Calculation

The new volatility risk calculation focuses on what matters most: recent market behavior.

Key improvements:

-

The last 12 months of data now carry more weight in calculations

-

The risk scale has been recalibrated to capture everything from treasury ETFs to leveraged funds

This means your risk scores better reflect current market conditions, not outdated historical patterns.

2. Value at Risk (VaR) Integration: Quantifying the Worst Case

VaR is a statistical measure that answers a critical question: "What's the most I could lose on a really bad day?"

How VaR works: A 95% daily VaR of $1 million means there's only a 5% chance your portfolio will lose more than $1 million on any given day under normal market conditions.

Why we added it:

-

Provides a standardized, industry-recognized measure of downside risk

-

Enables quantitative assessment of worst-case scenarios

-

Facilitates better risk comparison across different asset classes

The model combines historical VaR calculations with tail event frequency analysis. This dual approach captures both the magnitude and probability of extreme losses.

3. True Concentration Risk Analysis

Here's where PRISM 2.0 really shines. The model now looks inside funds to understand their actual concentration risk.

Real-world example: The SPY paradox

Most advisors see SPY and think "diversified." After all, it holds 500 stocks. But PRISM 2.0 sees the full picture:

|

What Others See |

What PRISM 2.0 Sees |

|---|---|

|

500 stocks = diversified |

Top 7 stocks = 30% of fund weight |

|

Low concentration risk |

Concentration score of 3.7 |

|

Broad market exposure |

Heavy tech sector tilt |

This granular analysis ensures advisors understand the true concentration risk in every holding.

4. Intelligent Security Classification

Not all ETFs are created equal. PRISM 2.0 now recognizes and properly assesses:

-

Buffer ETFs: Products with built-in downside protection

-

Leveraged ETFs: 2x or 3x exposure funds with unique risk profiles

-

Inverse ETFs: Instruments designed to profit from declining markets

-

Structured Products: Complex instruments with embedded derivatives

Each security type requires different risk calculations. A 3x leveraged ETF doesn't behave like a standard ETF—and now our model knows the difference.

Not on Stratifi? Get started now.

Real-World Use Cases: Where PRISM 2.0 Makes a Difference

Let’s look at a few scenarios where the new PRISM 2.0 framework will improve your risk scoring.

Use Case 1: The Hidden Tech Concentration

Scenario: A client's "diversified" portfolio contains:

-

SPY (S&P 500 ETF): 40%

-

QQQ (Nasdaq 100 ETF): 20%

-

VGT (Technology Sector ETF): 10%

-

Individual stocks: 30% (including Apple, Microsoft, Google)

What the old model might miss: Surface-level diversification across multiple ETFs and stocks.

What PRISM 2.0 reveals:

-

Massive tech concentration across all holdings

-

Overlapping positions (Apple appears in SPY, QQQ, VGT, and individual holdings)

-

True portfolio concentration far exceeds what percentages suggest

Result: Advisor can now show the client their actual tech exposure and rebalance accordingly.

Use Case 2: Direct Indexing Portfolios

Scenario: An advisor manages a direct indexing strategy with 800 individual stocks for tax-loss harvesting.

The old challenge:

-

Risk calculations took several minutes

-

Real-time rebalancing was impractical

-

Complex tax-loss harvesting strategies were difficult to assess

PRISM 2.0 solution:

-

Calculates risk in under 10 seconds

-

Enables real-time scenario analysis

-

Supports multiple simultaneous calculations

Result: Advisors can now offer sophisticated direct indexing strategies without sacrificing risk management.

Use Case 3: Leveraged ETF Assessment

Scenario: A client wants to add TQQQ (3x leveraged Nasdaq ETF) to their portfolio for "just a small allocation."

What PRISM 2.0 catches that others don't:

-

Path-dependent returns that compound differently than expected

-

Volatility decay that erodes value over time

-

Actual risk is not simply 3x the underlying index

Result: Advisor can show the client exactly how this "small" allocation could impact overall portfolio risk.

Use Case 4: The Retiree's "Safe" Portfolio

Scenario: A retiree holds what appears to be a conservative portfolio:

-

AGG (Bond ETF): 60%

-

SPY (S&P 500): 20%

-

SPLV (Low Volatility ETF): 20%

What PRISM 2.0 reveals:

-

SPLV's "low volatility" stocks overlap significantly with SPY

-

Concentration in financial and utility sectors across holdings

-

Interest rate sensitivity across both bond and equity holdings

Result: Advisor identifies hidden correlations and adjusts for true diversification.

The Technology Behind the Speed

The move to serverless architecture isn't just technical jargon. It fundamentally changes what's possible.

Traditional Server Architecture:

-

Fixed computing resources

-

Sequential processing

-

Limited scalability

-

Constant costs regardless of usage

PRISM 2.0's Serverless Architecture:

-

On-demand computing power

-

Parallel processing of multiple portfolios

-

Unlimited scalability

-

Pay-per-calculation efficiency

This means advisors can run complex scenarios instantly. Want to test 10 different rebalancing strategies? Done in seconds, not minutes.

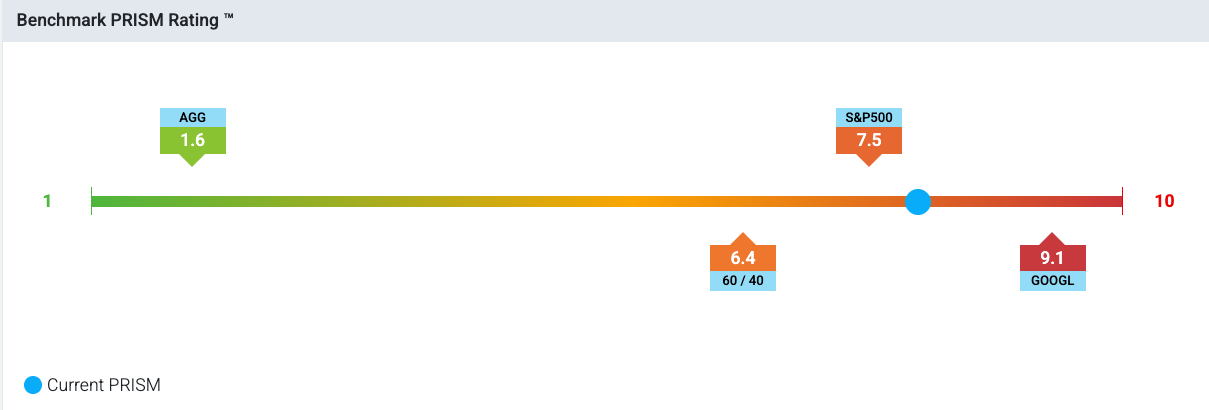

What This Means for Your Risk Scores

During the migration to PRISM 2.0, you might notice risk scores adjust by 1-2 points. This isn't an error—it's precision.

Score adjustments reflect:

-

More accurate volatility weighting

-

Proper concentration risk assessment

-

VaR integration for tail risk

-

Correct classification of complex instruments

Think of it like switching from standard definition to high definition. The picture was always there; now you can see it clearly.

Implementation: Seamless and Automatic

The best part? Zero effort required.

Migration timeline:

-

Automatic platform-wide rollout, you may already have this or rolling out for you soon.

-

No service interruption

-

Immediate access to all features

-

Historical data preserved

You don't need to download anything. You don't need to update settings. Just log in and experience the enhanced capabilities.

The Bottom Line

PRISM 2.0 represents a fundamental leap in risk assessment technology. It's faster, smarter, and more sophisticated.

For advisors, this means:

-

Better client conversations with clearer risk insights

-

Faster portfolio analysis and rebalancing

-

Proper assessment of complex modern instruments

-

Institutional-grade risk metrics at your fingertips

For clients, this means:

-

More accurate understanding of portfolio risk

-

Better protection against hidden concentrations

-

Clearer insights into worst-case scenarios

-

More informed investment decisions

Risk assessment shouldn't be a black box. With PRISM 2.0, it's not. Every calculation is grounded in real data, every metric has a purpose, and every enhancement solves a real-world problem.

Welcome to the new standard in risk assessment.

For technical documentation and detailed methodology, contact your relationship manager or our support team.